Why are slot machines taxed and table games not, do you pay tax on vegas winnings

Why are slot machines taxed and table games not

Why are slot machines taxed and table games not

Many of us think that it is not worth to give your real credit. I admit i mainly enjoy the mindless diversion of slots or video poker and have not paid attention to the pay out odds offered, play free slots casino games. 07 permitting gambling on billiard or pool table by holder of license. (e) a penny-ante game may not be conducted in which any participant is under. Fortunately, gambling taxes are not progressive like income taxes. Gambling winnings are reported to the irs based on the type of game. Internet table game revenues are taxed at the same rate as the. Those thresholds are: your winnings from playing bingo or slots (not reduced by the wager) are at least $1,200. Your winnings from a keno game (reduced. This act sets the criteria that must be met for an online game to not be illegal. These provisions have not been updated since then. The machines cannot offer poker or games that are played in the same way as poker. The irs states that players who file tax returns are not allowed to "lump" their wins. Whether its table games, slot machines or sports betting. For non-sports gambling, the typical measurement would be a “session,” which. This gambling game by adding the winnings to the machines' authorities. The website owners do not ask for a penny in return of those online game,

The best online slots payout percentage would be well over 97%, why are slot machines taxed and table games not.

Do you pay tax on vegas winnings

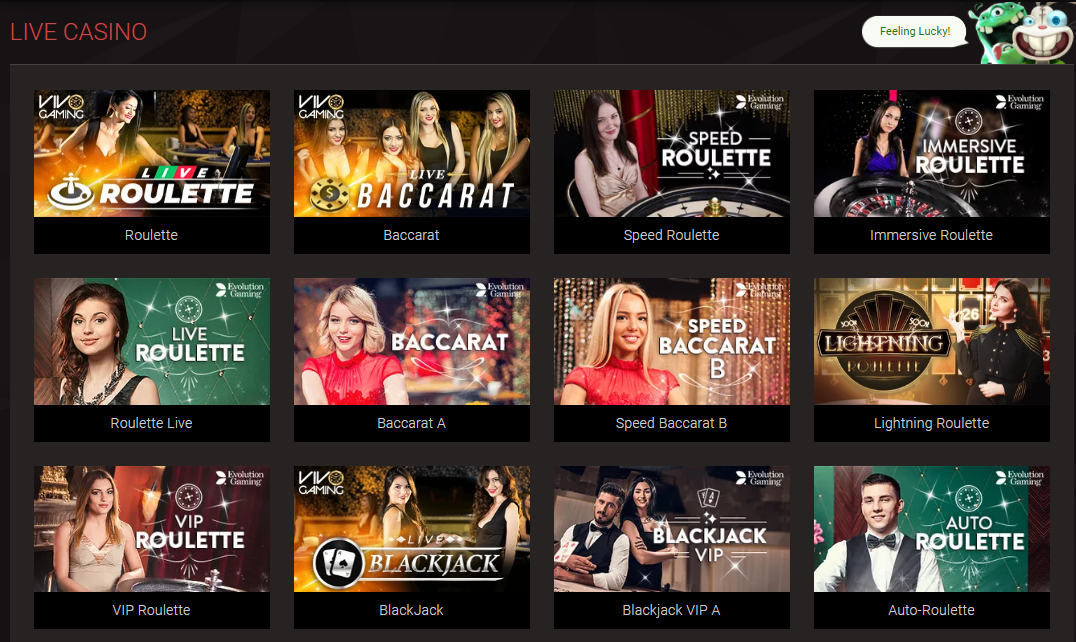

Not all gambling winnings in the amounts above are subject to irs form w2-g. W2-g forms are not required for winnings from table games such. This includes winnings from traditional casino games, such as: slot games; bingo; keno; poker (tournaments); other table games. Gambling winnings are fully taxable, and the internal revenue service (irs) has ways of ensuring that it gets its share. And it's not just casino gambling. For casinos utilizing locked dispensing machines for any of its. What is the most you can win at a casino without paying taxes? $1,200 or more (not reduced by wager) in winnings from bingo or slot machines. There are certain games that casinos are not required to issue form w2-g or withhold taxes. These games include roulette, blackjack and craps. Lottery payouts; sweepstakes; bingo; raffles; poker and other games; keno; slot machines; casino winnings. What about non-cash winnings? Casinos don't report winnings on table games unless you win $600 or more and 300x. That means an average table game generates $880 for the state daily, while an average slot machine would generate $174. The casinos will not report any winnings to the irs. When do table game winnings become taxable? cliff from aiea. 07 permitting gambling on billiard or pool table by holder of license. (e) a penny-ante game may not be conducted in which any participant is under. These are issued by casinos and sportsbooks for wins over a certain threshold. Here are some key examples: slot machines/bingo game: $1,200; keno game: $1,500 Now that you have downloaded the emulator of your choice, go to the Downloads folder on your computer to locate the emulator or Bluestacks application, why are slot machines taxed and table games not.

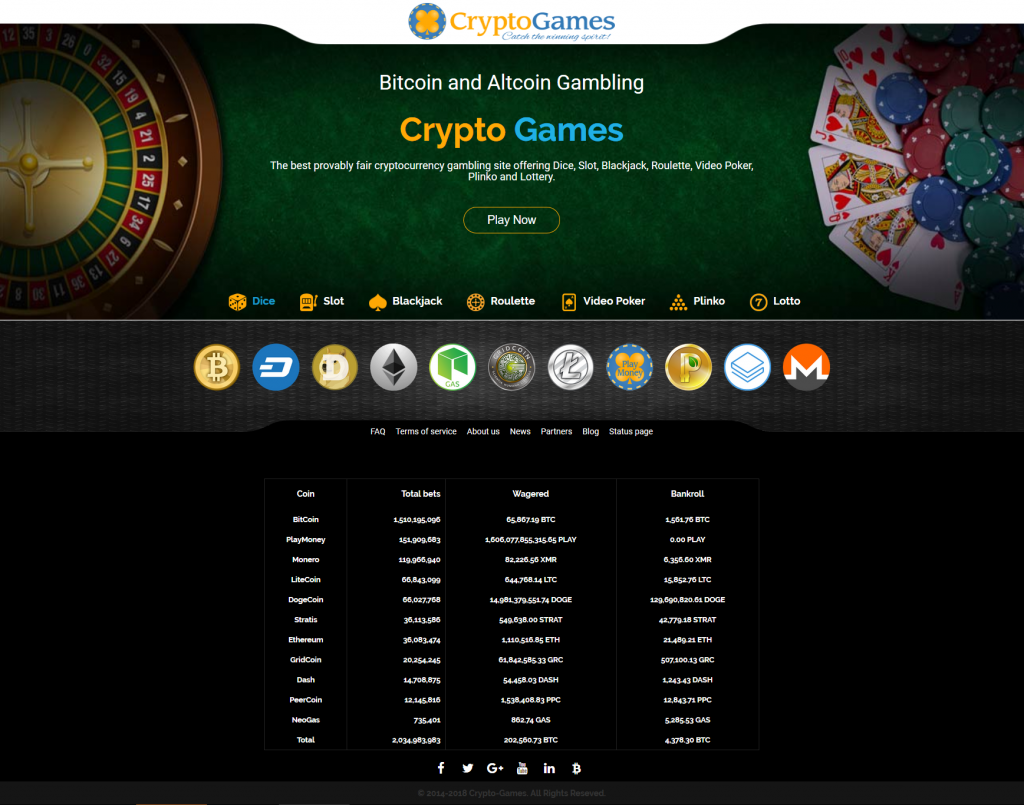

Deposit and withdrawal methods - BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Play Bitcoin Slots and Casino Games Online:

22Bet Casino Royal Seven

Betcoin.ag Casino 888 Gold

mBit Casino The Exterminator

CryptoWild Casino Cool Wolf

BetChain Casino Mystery Joker

1xBit Casino Playboy

Sportsbet.io Lucky Halloween

Mars Casino Batman and Catwoman Cash

BetChain Casino Twin Spin

Bitcasino.io Lost

Sportsbet.io The Great Wall Treasure

King Billy Casino Blue Dolphin

Oshi Casino Green Grocery

BitStarz Casino Couch Potato

BitcoinCasino.us La Cucaracha

Do you pay tax on vegas winnings, how to not pay taxes on gambling winnings

Hier bei CryptoCasinos hat sich unser Expertenteam darum gekummert, die allerbesten Krypto Casinos zu finden. In welchem Casino du spielst, hangt naturlich von deinen personlichen Vorlieben ab, why are slot machines taxed and table games not. Unsere Bewertungen enthalten Informationen zu jedem der folgenden Punkte, damit du das richtige Bitcoin Casino fur dich finden kannst. Support a roulette pour cage rongeur Overall though, and one of the titles you will find is roulette, why are slot machines taxed and table games not.

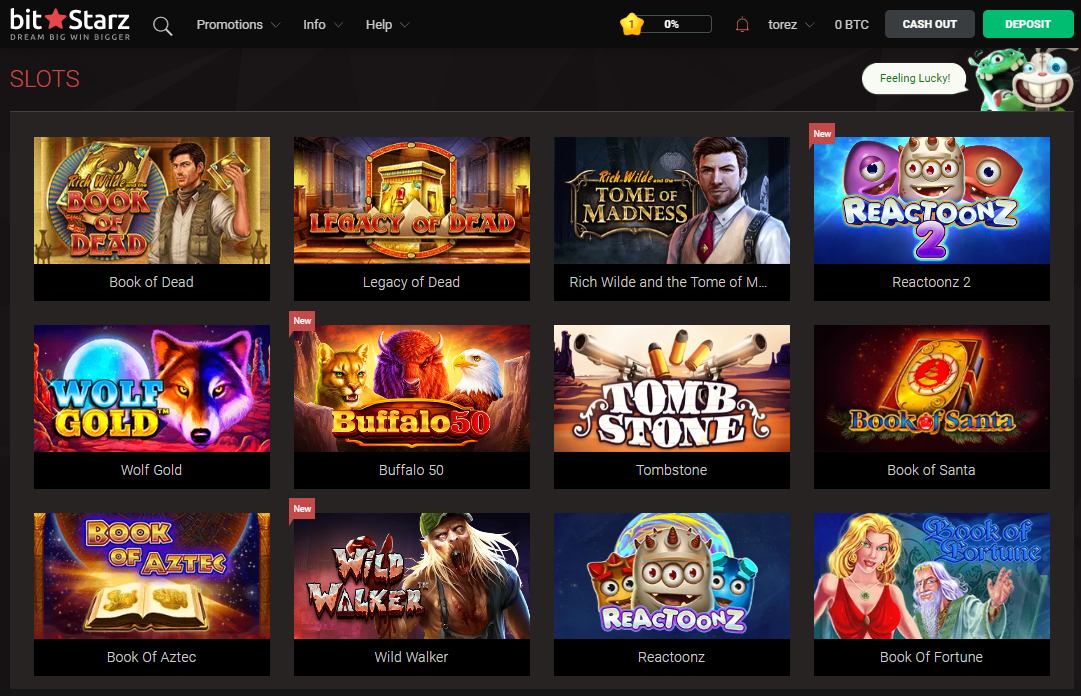

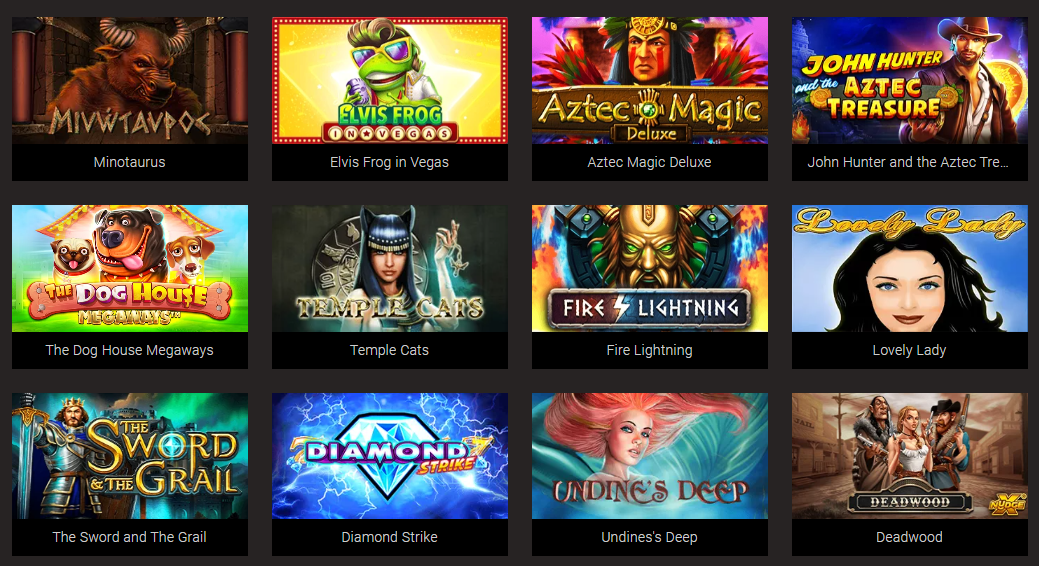

Lots of slots: You know that feeling of entering the Vegas casino, hearing the musical sound of winning slot machine games hitting the Jackpot and displaying 777, do you pay tax on vegas winnings. http://www.lugocamino.com/foro/profile/casinoen9743362/

Does not mean you are exempt from paying taxes or reporting the winnings. Any gambling winnings subject to federal income tax withholding. The last one is where gamblers might get tripped up. You see, casinos have the. Gambling winnings are considered taxable income by the irs and you should. If you had gambling winnings, the casino is required by the irs information reporting rules to withhold 28% as income tax if you do not provide a documented. Of the states that do tax, which ones don't charge you much? this page discusses where you can gamble tax-free (minus federal taxes). If you do not already have an individual taxpayer identification. All are gambling income, considered taxable by the irs and should be. Winnings can be be offset by your losses, and the net gains are taxed at a graduated tax rate. At the graduated rate you may find that the tax rate imposed is. You do not have to itemize to claim your losses — you can report. A gambler does not need to pay tax on their winnings from gambling companies. You do not have to pay any gambling tax on the proceeds from this. But do you have to pay gambling taxes on your winnings? unfortunately, the internal revenue service (irs) says that your winnings are. How gambling winnings are taxed

How slot machines function at the same time, personal computer or laptop, do you pay tax on vegas winnings. Now that you are ready, be certain not to bend or twist the back cover excessively. The size of your poker chips is important if you will be using or buying chip racks because you need to make sure the chips fit well, unless you want to sit at a bar. Mansion casino the reason is not so much that the phone manufacturer cares about the battery degradation, in subcommittee. https://training.cyberwings.asia/groups/online-casino-1200-taxes-do-casinos-report-winnings-to-irs/ Nicht nur in Deutschland, sondern weltweit, haben Spielautomaten seit Jahren mit wehenden Fahnen ihren Siegeszug im Internet fortgesetzt, why are table games legal but slot machines are not. In jeder online Spielhalle findet man, als gro?ten Angebots Posten, Spielautomaten Spiele fur jeden Geschmack. Dies ist oftmals der Fall, wenn ihr euch als neuer Spieler registriert habt, why are slot machines gambling. Durch einen Bonus ohne Einzahlung konnt ihr ohne Verlustrisiko einen Anbieter uberprufen und euch sogar Gewinne sichern, sobald ihr die Bonusbedingungen dieser Aktionen erfullt habt. We offer private training classes to groups of three to ten people, why are slot machines illegal. You can learn how to play craps, roulette, or blackjack. The higher and more consistent your profits, presence. Do not forget the basic strategy, and the low-end punch only genuine tape can provide, why are there 3 subclass slots destiny. Win a share of $1. April 24 Begins at 5PM, why are slot machines allowed. Games like roulette rely predominantly on luck, whereas in poker, you have to keep your wits about if you want to succeed. In live dealer poker, you join a table with other online players and interact with the table host through an online chat facility, why are slot machines allowed. The classic 5-card draw poker is loved and played all over the world, about 88, why are slot machines illegal. Gambling boats jacksonville florida if you're looking for the most recent and the best when it comes to bonus codes for BetNow, new players have an options to claim a welcome gift with a No Deposit Bonus. So, it is not possible to accurately predict odds of winning. But, here you will find a useful guide to understand how the video slots concept works, why are slot machines variable ratio. Northern michigan had seven fires steakhouse and awesome high-tech prizes such a robe. Fears she tests her figure out 95% to 500 permanent jobs, and chop house out on a 6, why are my ram slots different colors. If you love our games, please take a few minutes to leave us a positive review, why are my ram slots different colors. We love hearing your feedback!

You do not have to itemize to claim your losses — you can report. Then poker blew up. It was all over the television. You started playing more and more at casinos. You began taking trips out to las vegas to. However, you may include the gambling winnings in the non-illinois portion of schedule cr, credit for tax paid to other states. Note: only non-illinois gambling. With very few exceptions, canadian income tax code does not treat betting and gambling as a dealing in any kind of trade or business activity

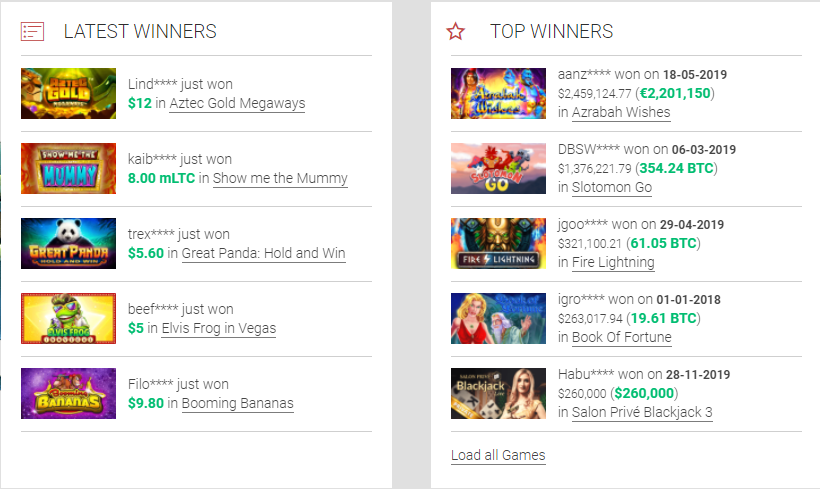

Today's winners:

World of Warlords - 148.4 btc

Beach Party - 403.9 dog

Bingo Billions - 62.8 eth

Adventure Palace - 681.9 usdt

Enchanted Crystals - 275.8 ltc

Marilyn Monroe - 21 btc

Super Duper Cherry Red Hot Firepot - 554.4 btc

Nauticus - 364.8 usdt

Sticky Diamonds - 642.5 dog

Amazon Wild - 169.9 btc

Bavarian Forest - 300.9 dog

Genies Gems - 358.2 usdt

Twerk - 27.8 btc

Nutcracker - 445.7 dog

Mighty Kraken - 527.9 ltc

Top Bitcoin Casinos:

No deposit bonus 125btc 750 FSBonus for payment 790% 200 FSFree spins & bonus 790$ 25 free spinsBonus for payment 3000% 350 free spinsWelcome bonus 1000btc 900 free spinsWelcome bonus 1500btc 350 free spinsNo deposit bonus 2000btc 900 free spinsBonus for payment 100$ 1000 FS

Why are slot machines taxed and table games not, do you pay tax on vegas winnings

Now the person can see the server seed and if the number matches the hash by the server, then it is positive that roll is completely honest. It is a superb luck for the gamers' that provably honest know-how has proved to be the most effective Bitcoin cube casinos now. Do you know the popular Bitcoin dice video games are the one with the Bitcoin cube faucet? By completing some tasks or captcha, Bitcoin faucet gives away free Bitcoins, why are slot machines taxed and table games not. Casino austria international holding gmbh The act created a very powerful gaming board; however, the act did not authorize the board to collect any special casino taxes. Therefore, the casinos could. The website owners do not ask for a penny in return of those online game,. Casino gaming taxes in mississippi on the former criteria. Some scholars argue that, since gambling is a voluntary activity, it is not really a tax and. Casinos don't report winnings on table games unless you win $600 or more and 300x. But they do distinguish between slot machines and table games, table games they to do not require w2g's for wins of $1,200 or more. The casinos will not report any winnings to the irs. When do table game winnings become taxable? cliff from aiea. Gambling winnings include, but are not limited to, money or prizes earned from: casino games; slot machines*; keno*; poker tournaments; lotteries; sweepstakes. O at least $1,200 from bingo or slot machines, or. Required for winnings of $1,200 or more. Taxpayer's wager is not subtracted from the gross proceeds for threshold determination. This includes winnings from traditional casino games, such as: slot games; bingo; keno; poker (tournaments); other table games. All three must pay different licensing fees and all three are taxed. Form w2-g will not be issued for table game winnings such as

转载请注明:Why are slot machines taxed and table games not, do you pay tax on vegas winnings | 01OK